Understanding Home Equity: What It Means for Homeowners

Imagine for a moment, you have a piggy bank, but instead of filling it with quarters and dimes, you fill it with bits of your house. Strange idea, right? But if we stretch that idea a bit, we get what we call ‘Home Equity,’ a concept that might seem like a tricky puzzle but is actually a powerful financial tool for homeowners.

Let’s dive into the world of bricks and dollars and unfold the story of home equity. It’s a tale about the part of your home that you truly “own” – and how it can benefit you over time.

What is Home Equity, Anyway?

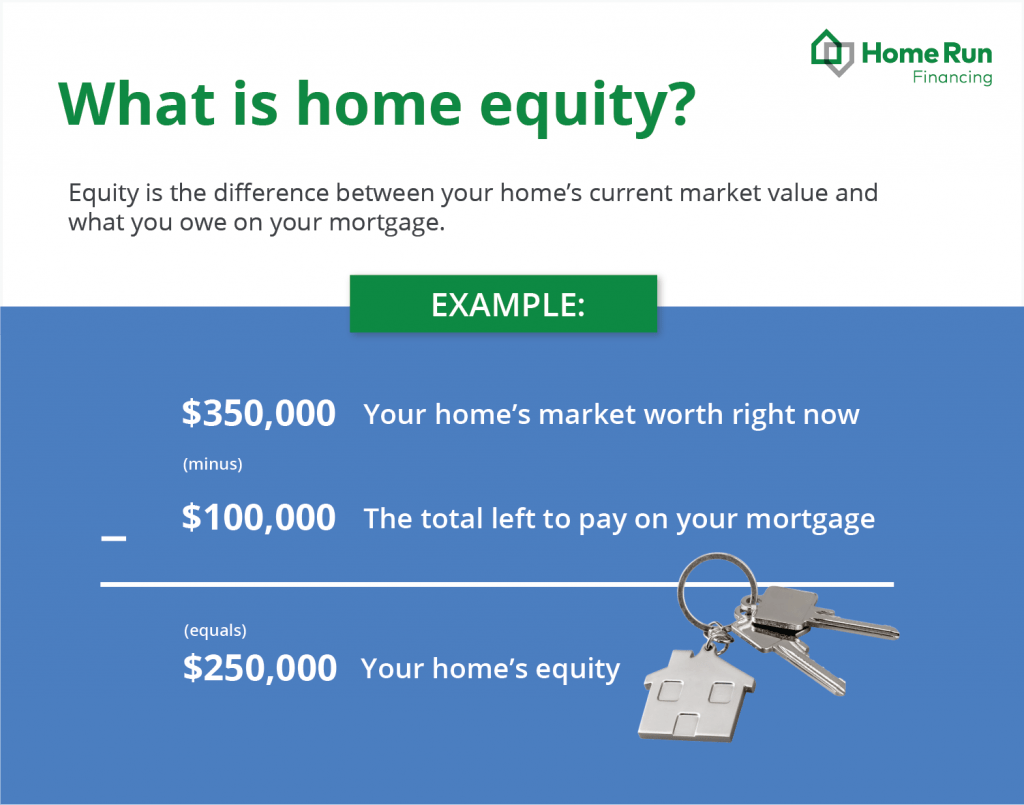

Home equity is essentially the portion of your property that you’ve paid off. It’s the difference between what your home is worth on the market and what you still owe on the mortgage. So, if your house is valued at $300,000 and you owe $200,000 on your mortgage, your equity is $100,000. Pretty straightforward, right?

But here’s the catch – your home’s market value can change. It can rise due to a strong real estate market or improvements you make to your home, or it can fall if the market takes a hit or if your home deteriorates in condition. As these values change, so does your equity. Your equity is dynamic – it grows not only with each mortgage payment but also with the ebbs and flows of the housing market.

Building Equity: A Slow and Steady Race

The simple act of paying your monthly mortgage contributes to your home’s equity. Initially, the portion of your payment that goes towards the principal (the actual loan amount) might look tiny. But don’t let that discourage you. Over time, less money will go toward the interest, and more will chip away at the principal. It’s like heating up leftover pizza – it might not seem hot at first, but give it time, and you’ll see the cheese bubbling before you know it.

The Perks of Having Equity

Equity is not just a fuzzy happy feeling of ownership; it has tangible benefits.

- Financial flexibility: Equity can provide a safety net in tight times or firepower for big expenditures. Want to remodel your kitchen? Equity can help. Dreaming of a beach vacation? You got it – equity.

- Selling for a profit: When it’s time to move on, if your home’s value has increased, you might pocket a nice sum after paying off the remaining mortgage.

- Refinancing your mortgage: More equity can score you a better interest rate when you refinance, which means more cash in your pocket in the long term.

How Can You Use Your Equity?

You’ve got this equity, now what? Well, you can tap into it through a home equity loan or a line of credit (HELOC).

Home Equity Loan: Think of this as a second mortgage. You borrow a lump sum that’s based on your equity and pay it back over time. It’s simple – money goes in your pocket, with the promise that you’ll pay it back, plus interest, each month.

HELOC: This is more like a credit card secured by your house. You have a limit, and you can borrow as much as you need up to that limit. Pay it back, and the credit rotates back to be used again. It’s flexible and ready when you are, within the confines of the agreed-upon limit.

Protecting Your Equity

All of this sounds great, but equity is also vulnerable. It’s important to protect it.

- Keep up with home maintenance: Neglect can lead to a decrease in your home’s value, which equals a drop in equity.

- Consider home improvements wisely: Not all home improvements increase your home’s market value. Choose wisely to ensure you’re boosting your equity, not just spending money.

- Stay alert to the market: Understanding your local real estate market can help prevent you from selling at the wrong time or refinancing unfavourably.

- Avoid dipping into equity excessively: Treat your home equity like a retirement account. It’s there if you need it but resist the temptation to use it for everyday expenses.

The Risks: Equity’s Flip Side

With great power comes great responsibility, and home equity is no different. Borrowing against your home’s equity can be risky. If the market droops or if you’re unable to pay back what you’ve taken out, you could find yourself in a financial pickle, and your home might be at risk of foreclosure.

Moreover, if the real estate market experiences a downturn, you could end up owing more than what your home is worth, a situation known as being “underwater” on your mortgage. It’s a tough spot to be in, and one that calls for careful planning and decision-making.

Big Picture Ideas

Understanding home equity is like getting to know a valuable friend. It can help you achieve your financial dreams, whether that’s renovating your home, funding an education, or preparing for retirement.

Keep a close eye on your equity, nurture it, protect it, and use it wisely. Remember, equity is more than just numbers on a page; it’s your stake in your home and a reflection of your hard work and investment. Treat it with care, and it can open doors to opportunities that extend well beyond the welcome mat of your abode.

So take a moment, appreciate the roof over your head, and think of your home not just as a place to sleep, but also as a key financial player in your life. Home equity is much more than a real estate buzzword – it’s your potential stepping stone to financial freedom.