The Impact of COVID-19 on the Housing Market

The onset of the COVID-19 pandemic in early 2020 ignited a sequence of events that rippled across various sectors, deeply affecting economies worldwide. The housing market, a cornerstone of the global economic landscape, was not immune to these profound changes. This article will explore the multifaceted impact that the pandemic has had on the housing market, shedding light on the unexpected outcomes and long-term shifts we’ve witnessed.

An Unprecedented Shift in Demand

When the world grappled with COVID-19, home suddenly took on a new meaning. With remote work becoming the norm for millions, people began to rethink their living spaces, sparking a dramatic shift in housing demand. As offices closed, the bustling city life lost some of its allure, and many sought refuge in the suburbs or rural areas, craving more space both inside and outdoors. This led to a peculiar phenomenon: a booming market for single-family homes, even as the economy faced a downturn. The increased demand, coupled with low mortgage rates designed to bolster the economy, resulted in a competitive housing market with rising prices.

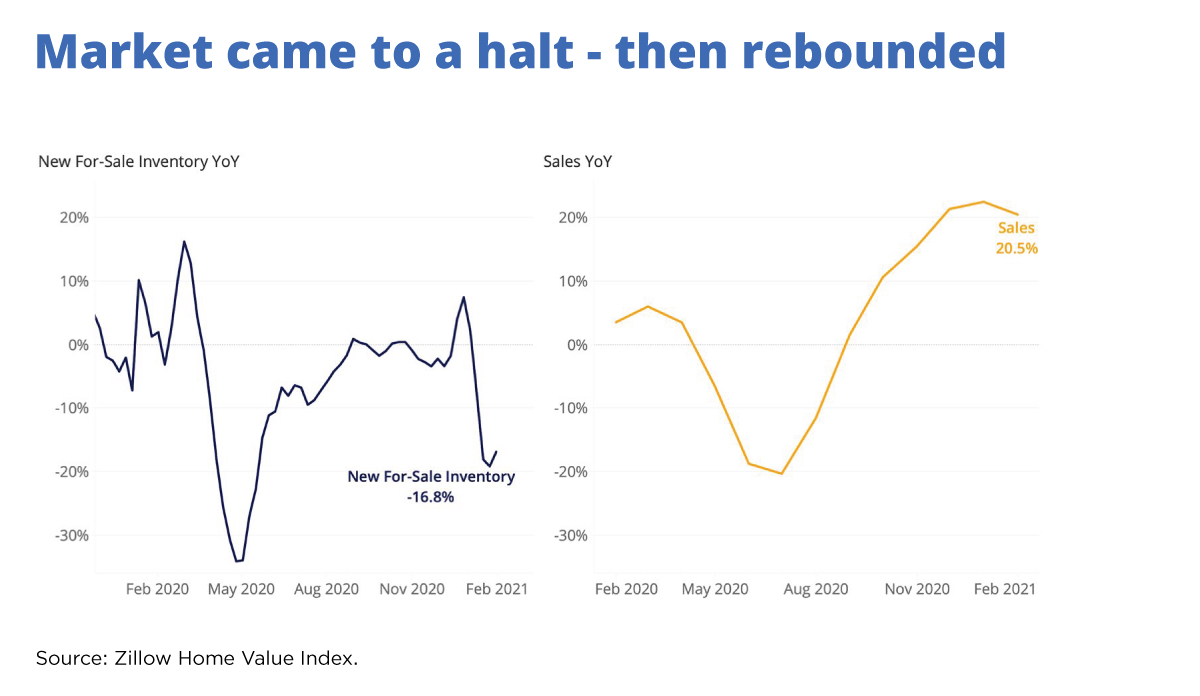

A Seller’s Market Emerges

As more people competed for fewer available properties, a seller’s market quickly took hold. Homeowners who decided to sell often found themselves entertaining multiple offers, some well above the asking price. This climate, although advantageous for sellers, posed significant challenges for buyers, particularly first-time buyers. With the cost of purchasing a home skyrocketing, many were priced out of the market, compounding existing issues of housing affordability and inequality.

New Construction: A Slow Response

The logical solution to meet rising demand would be to build more homes, but the pandemic introduced obstacles here as well. Supply chain disruptions, labor shortages, and increased costs for building materials, such as lumber, slowed new construction and renovations. The lag in response exacerbated the housing shortage and resulted in further price increases. Although new construction has started to pick up, it will take time to catch up to the ongoing demand.

Urban Real Estate Takes a Hit

The allure of cities has historically been tied to their vibrant work opportunities and cultural experiences. However, with restrictions on gatherings and the temporary closure of many businesses, city living lost some of its luster. Metropolitan areas, particularly those heavily reliant on tourism and service industries, experienced a more pronounced slump in real estate. Moreover, renters vacated apartments in search of more space, leading to a rare dip in rental prices in some of the most expensive urban markets. This turned out to be a temporary boon for those who chose to remain within the urban core and could take advantage of lower rents.

The Remote Work Revolution

Among the most significant drivers of change in the housing market is the remote work revolution. Many companies, having seen the potential for cost savings and maintaining productivity with remote staff, have decided to make remote work arrangements permanent. This revolutionary shift has decoupled many people’s living location from their place of work, allowing them to consider housing markets previously deemed too far from employment hubs. This flexibility led to a dispersal effect, where home buyers could explore areas that offer more for their money, thereby fueling the housing markets in smaller cities and towns.

The Impact on Renters

While homeowners with stable jobs saw their home equity rise, many renters faced an entirely different situation. The economic fallout from the pandemic was uneven, hitting certain job sectors particularly hard. Renters, who statistically have lower incomes and less saved, faced significant financial strain. Although eviction moratoriums provided temporary relief for some, the underlying issues of housing insecurity and the need for affordable housing solutions were magnified.

The Surge in Second Homes

Another trend that gained traction was the surge in purchases of second homes. Those with the means took advantage of low-interest rates to invest in vacation homes in less dense areas. These properties allowed them to escape the monotony of lockdowns and offered a change of scenery for remote work. This demand added another level of competition for homes, particularly in scenic areas that were previously seasonal markets.

Mortgage Rates and Borrowing

Mortgage rates dropped to historic lows during the height of the pandemic, in an effort to stimulate the economy. Low rates were a windfall for borrowers, leading to a refinancing boom. However, these same low rates also fueled the rise in home prices by increasing buying power. As we continue into the post-pandemic period, eyes are on interest rates and their anticipated rise, which may cool the market slightly by reducing demand.

Looking Ahead: The Post-Pandemic Market

The question on everyone’s mind is, “What’s next for the housing market?” As we move further away from the peak days of the pandemic, many of the trends are expected to persist. The embrace of remote work is likely to continue shaping where people choose to live. Moreover, the health of the housing market will remain closely tied to the overall economy, which, despite recovering, still faces uncertainties in the wake of the pandemic.

While some urban areas have begun to see a return of residents, the long-term impact on city housing markets is yet to be fully understood. The race toward space might slow down if cities rejuvenate and people are drawn back to the benefits of urban living.

One lasting impact of the pandemic may be on our collective expectations for our homes. The desire for more space, a home office, and outdoor areas is unlikely to fade completely, influencing home design and amenities for years to come.

Conclusion

The COVID-19 pandemic has been a disruptor like no other, and the housing market has felt its significant impact. From shifting demographics to evolving buyer preferences and the unprecedented challenges faced by renters, the full extent of these changes will continue to be analyzed and understood as we move into a future shaped by our new normal. What remains clear is that our homes have never been more essential to our lives, and the market will continue to adapt to meet the ever-changing needs and dreams of homeowners and renters alike.