Simple Investing Strategies for Everyone

Investing can often seem like a complex and daunting task, especially for those new to the world of finance. However, with a basic understanding and the right approach, anyone can start building a robust investment portfolio. In this article, we will explore some simple but effective investing strategies that are suitable for a wide range of investors, from beginners to those with more experience.

Understanding Your Investment Goals

Before you dive into the different types of investments, it is essential to understand your financial goals. Ask yourself:

– What are you investing for? Retirement, homeownership, education, or another long-term goal?

– How long do you plan to invest?

– What is your risk tolerance?

Answering these questions will help you choose the right investment strategy that aligns with your goals and risk comfort level.

Start with a Budget

The very first strategy is to invest within your means. Create a budget to determine how much of your income you can comfortably allocate to your investments without impacting your essential expenses. A common rule of thumb is the 50/30/20 rule – 50% of your income for necessities, 30% for wants, and 20% for savings and investments. This can vary based on personal circumstances, but it’s a good starting point.

Consider an Emergency Fund

Before you start investing, it’s vital to have an emergency fund. This is a cash reserve meant to cover unexpected expenses, such as medical bills or job loss. Having this safety net ensures you don’t need to dip into your investments, which may incur penalties or losses if withdrawn at the wrong time.

Diversify Your Portfolio

One of the most crucial strategies in investing is diversification. This means spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the risk of a single investment’s poor performance significantly impacting your entire portfolio.

Invest in Low-Cost Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are great for those looking for an easy and low-cost way to diversify. These funds track a market index and provide exposure to a wide array of stocks or bonds. Due to their passive management style, they have lower fees than actively managed funds, making them an efficient way to invest in various companies or industries.

The Power of Compound Interest

Compounding is one of the most powerful concepts in investing. It refers to the ability of an asset to generate earnings, which are then reinvested to produce their own earnings. Over time, even small, regular investments can grow to substantial sums, demonstrating that it’s not just about how much you invest, but also how long you invest for.

Automate Your Investments

Maximize the benefit of compounding by setting up automated contributions to your investment accounts. This strategy, often referred to as “dollar-cost averaging,” involves regularly investing a fixed sum of money, regardless of the market conditions. This can help temper the volatility in asset prices and reduce the emotional component of investing.

Retirement Accounts

Taking advantage of retirement accounts like 401(k)s and IRAs can offer tax benefits that boost the growth of your investments. Contributions to these accounts may reduce your taxable income, and the investments within the accounts typically grow tax-deferred until retirement. Some employers also offer 401(k) match programs, which can further enhance your retirement savings.

Keep a Long-Term Perspective

The market will fluctuate, but maintaining a long-term perspective is key. Short-term volatility should be expected, but history has shown that the stock market tends to grow over time. Don’t let short-term market movements deter you from your long-term goals.

Learn Continuously

Investing isn’t a set-it-and-forget-it endeavor. It requires ongoing education. Stay informed about market trends and understand what you are investing in. Read books, follow finance news, and perhaps even consider talking to a financial advisor if your situation is more complex.

Review and Adjust as Necessary

Over time, your risk tolerance or investment goals may change. As such, it’s important to review your investments periodically and make adjustments if needed. This can involve rebalancing your portfolio to maintain your desired asset allocation or shifting your strategy as you get closer to your investment targets.

Common Pitfalls to Avoid

– Avoid high-fee investment products that can eat into your long-term returns.

– Stay away from investment strategies that promise quick and guaranteed returns; they often carry hidden risks.

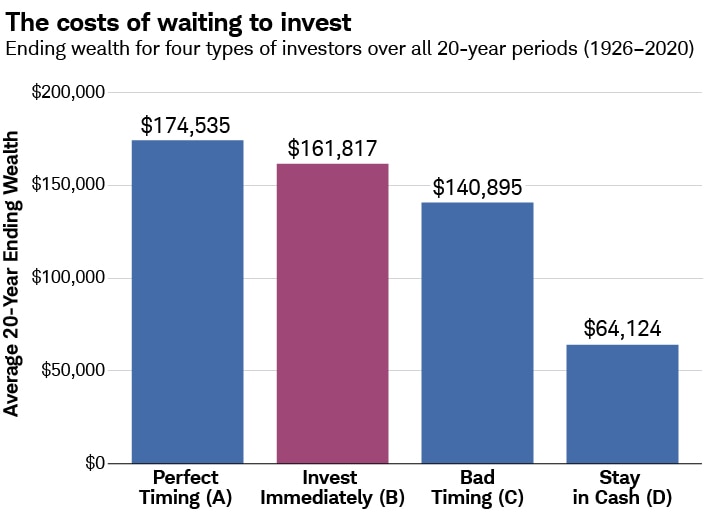

– Don’t try to time the market. It is nearly impossible to do consistently and can lead to significant losses.

Conclusion

Investing need not be overly complicated. By setting clear goals, creating a budget, diversifying your portfolio, and focusing on the long-term, you can navigate the world of investing successfully. Remember to leverage tax-advantaged retirement accounts, automate your investments, and keep learning. With these simple strategies, financial growth and a secure future are within reach for every investor.

Implementing these strategies can start you on a path to financial security. Remember, the earlier you start, the more you can potentially benefit from compounding. Take the first step today, and keep building on your investment knowledge as you grow your wealth for a brighter financial future.