Navigating the Home Buying Process: From Offer to Closing

Buying a home is an adventure. Yes, an adventure with paperwork and some waiting, but it’s a journey from deciding you want a new place to turning the key in your new front door. Let’s talk about the steps you’ll need to take from making an offer to that fantastic moment when the property is finally yours—the closing.

Step 1: Finding Your Perfect Home

First, you’ve got to find the right house—location, size, price. Once you’ve got your heart set on your future home, it’s time to make it officially yours.

Step 2: Making an Offer They Can’t Refuse

When you’re ready to say, “I want this house,” you make an offer. Your real estate agent will help you decide on the right price and terms. Think of this like the opening line of your favorite book – it’s got to grab the seller’s interest.

What’s in an offer? The price you’re willing to pay, of course, plus any conditions. Maybe you want the owners to fix up that funky bathroom before you move in. Or perhaps you “love” the house so much you can overlook its quirks.

Don’t forget the earnest money—a deposit showing you’re serious about buying. It’s not your entire savings, just a small piece of the pie to show you mean business.

Step 3: The Waiting Game—Offer Accepted or Not?

After you’ve made your offer, it’s time to wait. The seller might say “yes” right away, come back with a counteroffer, or even say “thanks, but no thanks.” If they counter, you can accept, counter back, or walk away. Like a dance, you both take steps until you agree.

Step 4: Home Inspection and Appraisal

Hooray! Your offer gets the thumbs up. Next up: the home inspection. A professional will check out the house from top to bottom, making sure everything is up to snuff. If they discover a leaky roof or a dance party of termites in the basement, you’ll want to know before you move in.

An appraisal is like a reality check. It’s when an expert comes in to say, “Yes, this house is worth what you’re planning to pay.” Lenders need this peace of mind because, let’s be honest, they’re the ones loaning you a big chunk of money.

Step 5: Secure Your Loan—Financing Your Dream

Speaking of money, let’s talk about getting your mortgage. You’ve probably been pre-approved if you’ve been planning right, but now it’s time for the final approval. Paperwork, credit checks, and financial details—it’s all about convincing the bank you’re good for the cash.

Think of this as the stage where you promise to pay for your new home over time. A solid job and a good credit history are your best pals here.

Step 6: All About the Paperwork—The Home Stretch

Getting close now! When your loan is a home-run, your lender will give you something called a “commitment letter.” This means they’re committed to giving you the loan. It’s a big deal—like getting a gold star on your homework.

But even after you get this letter, there are still some ducks you need to get in a row. House insurance, for one. No lender will give you money without ensuring their investment is safe. So, get yourself some insurance against fires, floods, or any other house nightmares.

Step 7: Closing Time—The Final Countdown

All set? Now it’s time for the grand finale—the closing. It’s when you and the seller, your agents, and probably a lawyer or two meet up and make everything official.

You’ll pay your down payment and closing costs, which are like the cover charge for this property party. Your lender will pay the seller, and in exchange, you’ll get a boatload of paperwork to sign. Don’t be surprised by the mountain of documents; just get ready to sign your name—a lot.

Finally, after all the T’s are crossed and I’s dotted, the keys to your new home are handed over. Congratulations, you did it! You’re officially a homeowner.

In Conclusion

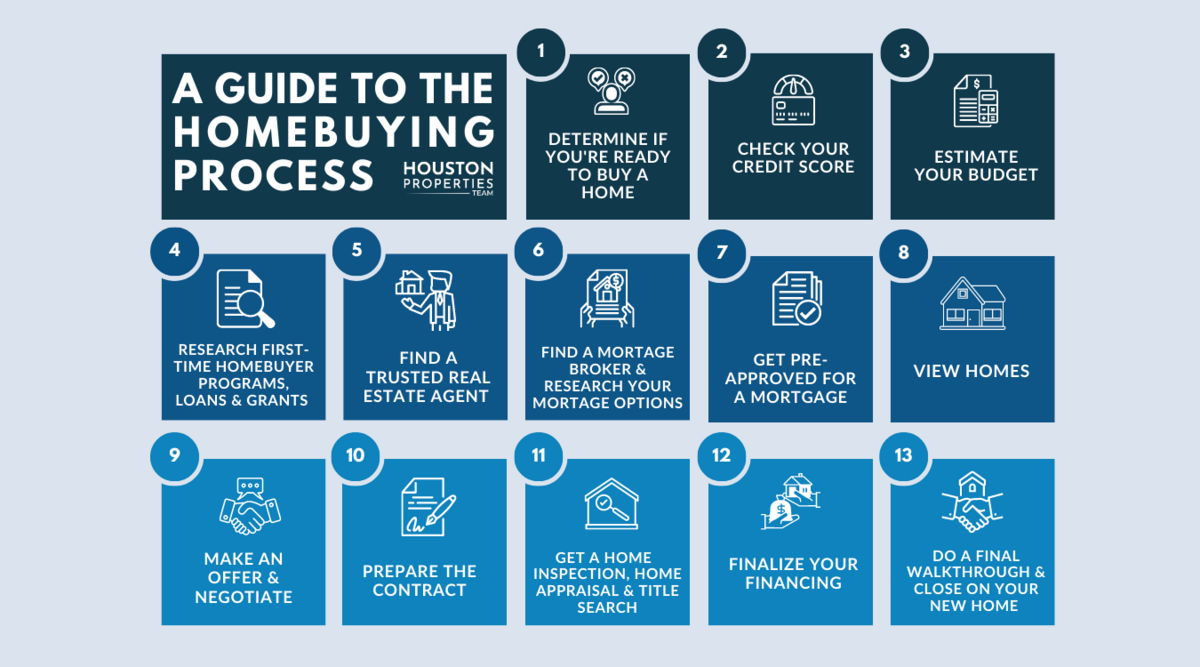

Navigating the home buying process can feel like a mix of excitement, anticipation, and plenty of details. From making your initial offer to the momentous closing day, each step brings you closer to owning a place to call your very own. Remember, it’s not a race. Take your time, ask questions, and lean on professionals like real estate agents and mortgage advisors.

In the end, when you unlock the door to your new home for the first time, the journey—the inspection dramas, the paperwork sagas, and the waiting periods—will all be worth it. Your adventure in home buying concludes with a happy ending, a fresh start in a place where new memories await. So, take a deep breath, tackle each step as it comes, and enjoy the ride to homeownership.