Manage Risk With Long Term Care Insurance

Think about a future where you might need someone to help you with your day-to-day living. It’s not something we like to picture, but it’s a reality that comes with getting older. Here’s where long term care insurance steps in. It’s like a safety net that catches you when the tasks of everyday life become too tough to manage on your own. This article will walk you through what long term care insurance is, why it’s important, and how it can help you manage risks that come with aging.

Understanding Long Term Care Insurance

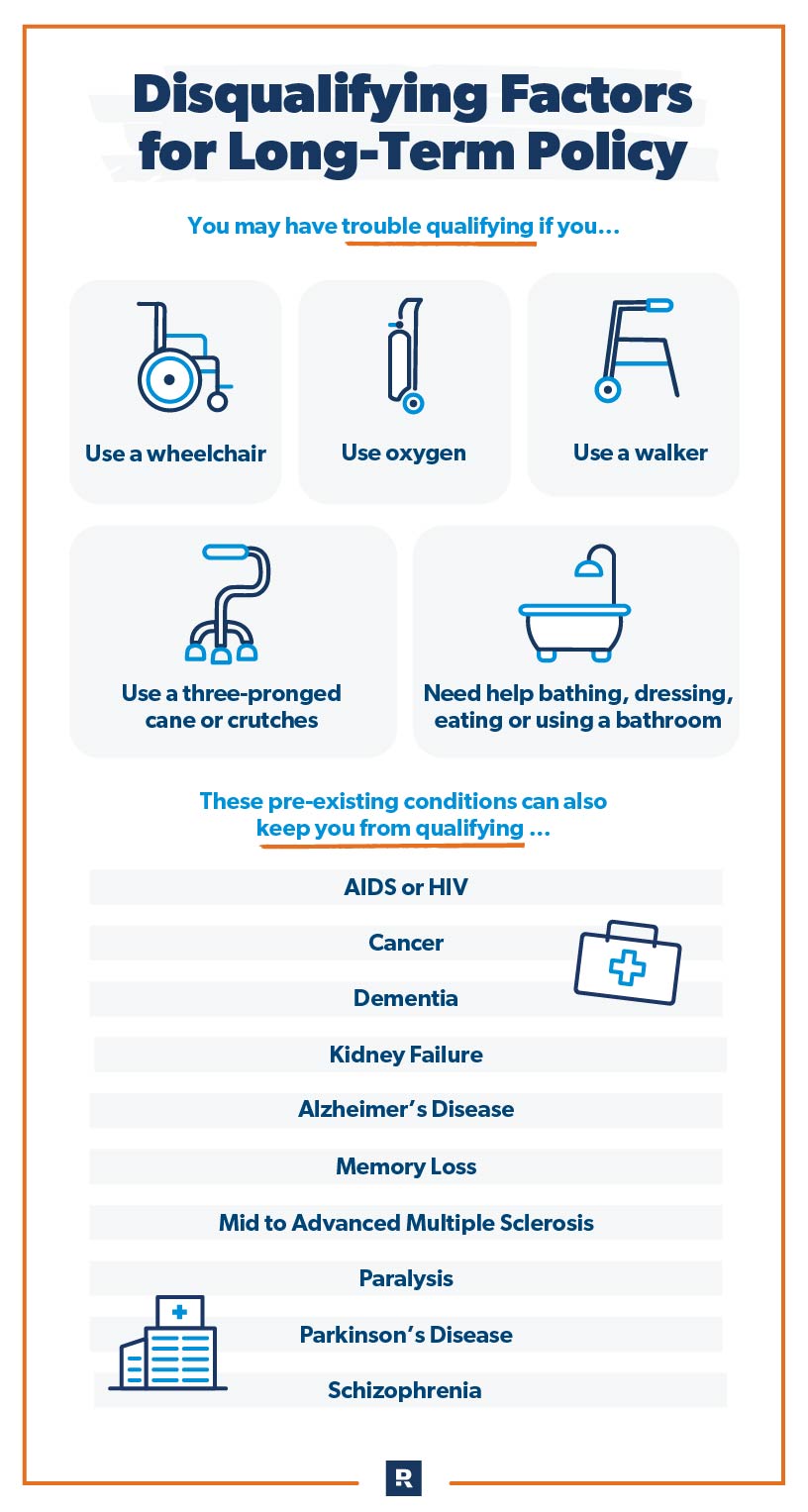

First off, what is long term care insurance? In simple terms, it’s a type of policy that pays for the care you might need if you have a chronic illness, disability, or other condition that means you can’t look after yourself. This could be care at home, in a community organization, or in a specialized facility.

You might wonder, “Isn’t this what health insurance is for?” It’s a common question, but here’s the deal: health insurance typically covers costs for doctors, hospital stays, and medication. Long term care insurance covers services that help you with personal tasks like getting dressed, eating, or bathing—things you might need when you deal with the tougher side of aging.

Why Consider Long Term Care Insurance?

So, why should you even consider getting long term care insurance? Think of it as a financial planning tool to protect your savings and give you more control over how and where you receive care.

- Protect Your Savings: Without insurance, long term care costs can drain your savings fast. Having insurance helps keep your nest egg intact for you and your family.

- Choices in Care: With an insurance policy, you get to choose whether you receive care at home or elsewhere. It means you could stay in your familiar surroundings for as long as possible.

- Relieve Family Stress: It’s tough on family members to become full-time caregivers. A long term care policy means professional help is available, taking the burden off loved ones.

How Does Long Term Care Insurance Work?

Like most insurance plans, with long term care insurance, you pay a regular premium. In return, the insurance company agrees to pay a daily or monthly amount towards your care if and when you need it. The amount and how you receive the benefit can vary based on the policy you choose.

There’s also something called the ‘elimination period.’ It’s like a deductible, but instead of paying money, you’re waiting for a set amount of time before the benefits kick in. Choosing a longer elimination period can lower your premiums, but it also means you’ll wait longer before the insurance starts to pay out.

When to Buy Long Term Care Insurance

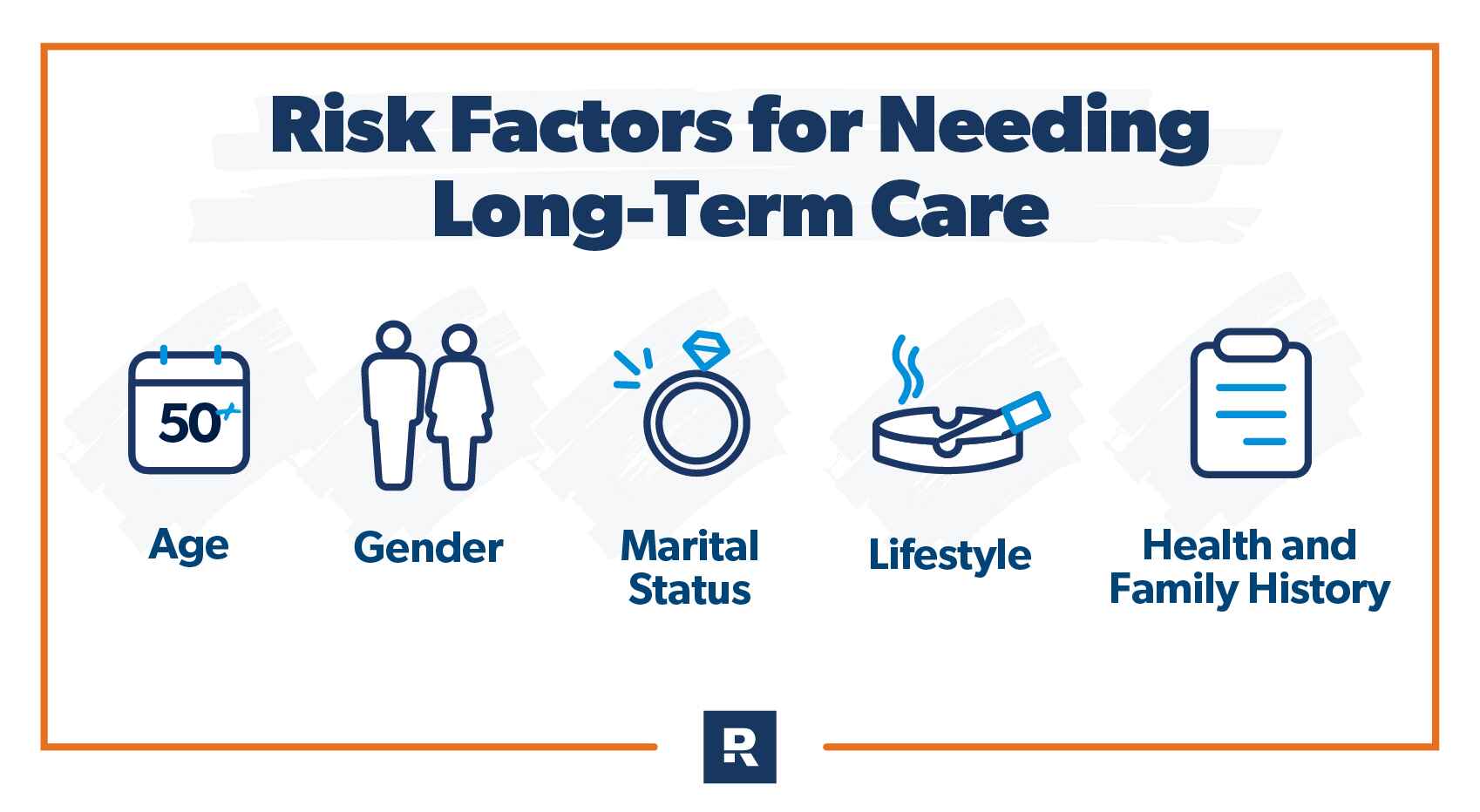

Timing is everything with long term care insurance. Buy it too late, and you might not qualify or pay sky-high premiums. So when’s the best time? Most experts suggest looking into it in your 50s or early 60s. This approach hits the sweet spot, giving you better rates and a higher chance of being approved.

Of course, each person is different. You’ll need to consider your health, family history, and financial situation. Talking to a financial advisor is a smart move to figure out what’s best for you.

Choosing the Right Policy for You

Finding the right policy can be like searching for a needle in a haystack. But here are a few key features to look for:

- Benefit Amount: The daily or monthly amount the policy will pay for your care.

- Benefit Period: How long the policy will pay for your care. This could be a few years or the rest of your life.

- Inflation Protection: With this, your benefit increases over time, keeping up with the rising cost of care.

- Flexibility: Some policies offer more flexibility in the types of services and where you receive care.

And don’t forget to check the insurance company’s reputation and financial strength. You want them to still be around when it’s time to use your policy!

Costs and Paying for Long Term Care Insurance

Let’s talk about the elephant in the room: cost. Yes, long term care insurance premiums can be hefty, but the earlier you get it, the more manageable the costs. Your health, age, and the amount of coverage all determine your premium. And here’s a pro tip: premiums are generally lower when you’re younger and healthier.

As for paying those premiums, you’ve got some options. Some people use savings, others might use income from their job or from investments. If you’re still working, check if your employer offers long term care insurance as part of a benefits package—sometimes you can get a better rate that way.

Are There Alternatives to Long Term Care Insurance?

Long term care insurance isn’t the only game in town. There are alternatives like self-insuring—essentially saving enough on your own to cover care costs. There are also life insurance policies with long term care riders, and annuities with similar features. These choices all have their pros and cons, and they might work better for you depending on your situation.

Make an Informed Decision

Making a decision on long term care insurance isn’t a walk in the park. It needs careful thought, a bit of research, and often, advice from a financial pro. Consider your personal risks, family history, and what you hope your future will look like. And remember, while we all want to stay hale and hearty forever, planning for the “what ifs” is a crucial step in guarding your well-being and your wallet.

In essence, long term care insurance is all about managing risk. It’s about facing the truth that, as we age, our needs change. And when those changes come, it’s empowering to have choices about our care and how we live. That’s what managing risk with long term care insurance is really all about—preserving your independence, protecting your financial future, and keeping life’s curveballs from knocking you off your feet.

Final Thoughts

The road of life is unpredictable, and long term care insurance is one important tool that can help prepare for its twists and turns. Remember, the choices you make today about managing risks can define your tomorrow. So, take the time, get informed, and consider whether long term care insurance is right for you. It’s not just about insurance; it’s about investing in a future where you have the freedom and support to live life on your terms, no matter what comes your way.