# Le

arn About Medicare Enrollment Windows

Navigating the world of Medicare can feel like walking through a maze – you know you need to find your way to the end, but the path isn’t always clear. Understanding the different Medicare enrollment periods is crucial for making informed decisions regarding your healthcare coverage. Just like fitting the pieces of a puzzle together, let’s break down the enrollment periods into easily digestible pieces that will help clear the path to your Medicare journey.

## What is Medicare?

Before we delve into enrollment windows, it’s essential to grasp what Medicare is. In simple terms, Medicare is a US federal health insurance program mainly designed for people who are 65 or older. It also serves younger individuals with disabilities and people with End-Stage Renal Disease (ESRD). Medicare comes in several parts that cover different aspects of healthcare, and getting to know these is key to figuring out when and how you can sign up.

## Understanding Medicare Parts

– **Part A (Hospital Insurance)** This covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health care.

– **Part B (Medical Insurance)** Deals with certain doctors’ services, outpatient care, medical supplies, and preventive services.

– **Part C (Medicare Advantage Plans)** An alternative to Original Medicare (Part A and Part B), these plans are offered by private companies approved by Medicare. They include all services covered under Part A and Part B and often include extras, such as prescription drug coverage, at an additional cost.

– **Part D (Prescription Drug Coverage)** This adds prescription drug coverage to the Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans.

Now, let’s talk about when you can join, switch, or drop these parts because timing is crucial.

## Initial Enrollment Period (IEP)

Your first chance to sign up for Medicare is called the **Initial Enrollment Period (IEP)**. This window opens three months before the month you turn 65 and closes three months after that month, giving you a generous seven-month timeframe. For example, if you’re born on July 14, your IEP starts on April 1 and ends on October 31.

Signing up during this period is important because if you miss it, you might have to wait until the General Enrollment Period and could face late enrollment penalties. So, mark your calendars and set reminders—this is a date you don’t want to forget.

## General Enrollment Period (GEP)

If the initial enrollment period slips by, don’t fret. The **General Enrollment Period (GEP)** is the safety net that runs from January 1 to March 31 annually. However, there’s a catch. If you sign up during GEP, your coverage starts July 1, which means there could be a gap in your coverage. Plus, you may have to pay higher premiums for late enrollment in Part A and/or Part B. It’s not the ideal situation, but it ensures you still get a shot at enrollment.

## Special Enrollment Periods (SEPs)

Life is full of surprises and changes, and Medicare gets that. **Special Enrollment Periods (SEPs)** are custom-made timeframes that allow you to make changes to your Medicare coverage when certain life events happen, such as moving or losing other insurance coverage. The rules about when you can make changes and the types of changes you can make are different for each SEP, so you’ll need to check the specific rules for the event that applies to you.

A notable SEP occurs when you or your spouse (or family member if you’re disabled) are working and you’re covered by a group health plan through the employer or union. You can sign up for Part A and/or Part B anytime as long as you or your family member is working, and for eight months after the job ends or the coverage stops, whichever happens first.

## Medicare Advantage Open Enrollment Period (MA OEP)

If you’re enrolled in a Medicare Advantage Plan, you have an opportunity to switch up between January 1 to March 31 each year during the **Medicare Advantage Open Enrollment Period (MA OEP)**. During this period, you can:

– Switch to a different Medicare Advantage Plan with or without drug coverage

– Disenroll from your Medicare Advantage Plan and return to Original Medicare, and if you choose to do so, you can join a Medicare Prescription Drug Plan

Be aware that you can only make one change during this window, so choose wisely!

## Fall Open Enrollment Period (Annual Election Period – AEP)

The flexible and ever-important **Fall Open Enrollment Period**, also known as the **Annual Election Period (AEP)**, runs from October 15 to December 7 each year. During AEP, you can:

– Switch from Original Medicare to Medicare Advantage, or vice versa

– Change from one Medicare Advantage Plan to another (with or without drug coverage)

– Join a Medicare Prescription Drug Plan, switch from one Medicare drug plan to another, or drop your prescription drug coverage altogether

The changes you make will take effect on January 1 of the following year. This period gives you the freedom to adjust your healthcare trajectory based on what’s right for you at this point in your life.

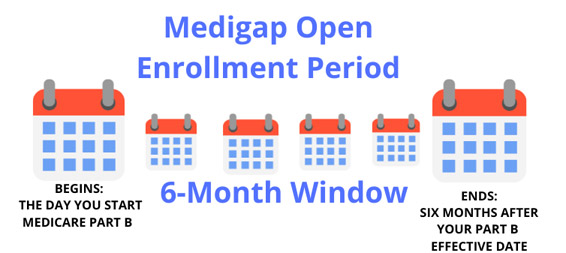

## Medicare Supplement Open Enrollment Period

Lastly, there’s the **Medicare Supplement Open Enrollment Period**. It starts the first month you’re at least 65 and enrolled in Part B and lasts for six months. During this time, you have a guaranteed right to buy any Medicare Supplement policy (Medigap) sold in your state, regardless of your health status. After this period, you may not be able to buy a Medigap policy, or if you’re able to, it could cost more due to past or present health problems.

## The Takeaway

Understanding these enrollment periods is like having a map to find the best route for your healthcare needs. Each period offers specific opportunities to sign up for, switch, or drop parts of your Medicare coverage—ensuring you have the flexibility to tailor your healthcare as your life unfolds. Plan ahead, mark significant dates on your calendar, and never hesitate to seek help if you find yourself lingering at a crossroads, unsure of what turn to take next in your Medicare journey. Remember, staying informed means staying in control of your health and well-being.

Navigating Medicare enrollment doesn’t have to be a harrowing experience. With clarity about these enrollment periods, you’re well on your way to making Medicare work for you, so you can focus on living your healthiest, happiest life.