Breaking Down Common Real Estate Terms

When you step into the world of property buying, selling, or renting, you might find yourself adrift in an ocean of jargon that can seem daunting. The real estate market has its unique language that can be difficult to navigate, especially if you’re dipping your toes for the first time. The trick is to familiarize yourself with the most common terms so that you can participate in the conversation and make informed decisions.

Let’s tackle some of these key terms and break them down into bite-sized, easy-to-understand definitions. Welcome to Real Estate Jargon 101!

1. Appraisal

An appraisal is like a snapshot of a home’s value. It’s an expert estimate that seeks to determine how much a property is really worth. This is crucial when securing a mortgage, because lenders want to make sure they’re not lending more money than the home’s actual value. Think of it as a financial safety check for both parties.

2. Escrow

Imagine escrow as a neutral third party in a transaction. When you put money in escrow, you’re placing it in the hands of a separate entity that will hold on to it until all parts of a deal are met. This can include down payments or other important documents. It’s like a referee in a game, ensuring that each party plays by the rules before the final whistle blows.

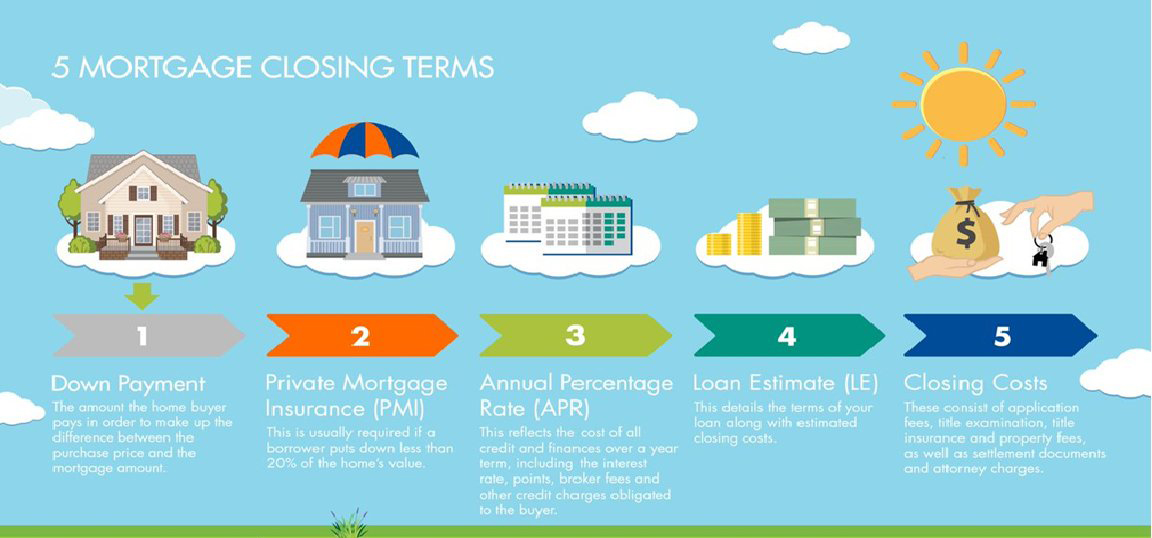

3. Closing Costs

Closing costs are the finish line expenses that buyers and sellers typically pay to complete a real estate transaction. These can include taxes, loan processing fees, and title insurance, among others. They vary widely based on your location and the property itself but usually range from 2% to 5% of the purchase price. It’s the financial stretch in your home buying marathon.

4. Contingency

Think of a contingency as a safety net. These are conditions outlined in a real estate contract that must be met for the deal to go through. For instance, a buyer might include a financing contingency that allows them to back out if they can’t secure a mortgage. It’s like having a plan B, ensuring that there are ways to escape unscathed if things don’t go as planned.

5. Fixed-Rate vs. Adjustable-Rate Mortgages

When we talk about mortgages, there are generally two types you’ll hear about: fixed-rate and adjustable-rate. Fixed-rate mortgages have interest rates that stay the same through the life of the loan, which means your monthly payments won’t change. Adjustable-rate mortgages (ARMs), on the other hand, have interest rates that can fluctuate, often starting lower but then moving up or down with market trends. It’s the difference between knowing your payment is set in stone or riding the roller coaster of market rates.

6. Home Inspection

A home inspection is a thorough check-up of a property, performed by a qualified inspector. They’ll examine everything from the foundation to the roof, checking for issues that might need fixing. Consider this a deep dive into a home’s health, giving you the peace of mind that you’re making a sound investment or uncovering potential problem areas before making a purchase.

7. Pre-approval

Getting pre-approved for a mortgage means a lender has looked at your financial background and determined how much they would lend you. It’s like having a passport for the house-hunting journey, showing sellers that you’re a serious buyer with the financial backing to seal the deal.

8. Real Estate Agent vs. Realtor

While often used interchangeably, these terms have different meanings. A real estate agent is licensed to help people buy, sell, or rent properties. A Realtor, on the other hand, is a real estate agent who is also a member of the National Association of Realtors (NAR), meaning they must adhere to a strict code of ethics. It’s an agent vs. agent-plus situation, with the plus being a membership with a stamp of ethical practices.

9. Title

The title is the formal document that shows ownership of a property. When you buy a house, the title is transferred to you, declaring you as the new owner. Think of it as the ultimate piece of paper that says ‘this property is officially yours’.

10. Equity

Equity refers to the portion of your property that you truly own — it’s the difference between the home’s value and how much you owe on your mortgage. As you pay down your mortgage, your equity increases. Imagine slowly filling up a jar — every payment is more sand in your bucket, increasing your stake in your property.

11. Listing

A listing is a property that is up for sale. It’s the advertisement in the real estate world, showcasing a property with details about its features, price, and more. When you’re browsing for homes online or in a real estate agent’s office, you’re perusing listings.

12. Offer

An offer is what you put on the table when you want to buy a home. It includes the price you’re willing to pay as well as any conditions you’re laying down. It’s your bid in the auction of real estate where you tell the seller, ‘I want this, and here’s what I’m willing to propose’.

Now that you’re armed with an understanding of these common real estate terms, you can wade more confidently through the waters of property dealings. This list is just a springboard into the vast vocabulary of real estate, but it covers the essentials that will give you a strong start. Remember, whether you’re a first-time homebuyer or an old hand in the market, clarity and knowledge can transform an overwhelming process into an exciting journey. Keep learning those terms, ask questions when in doubt, and before you know it, you’ll be speaking real estate like a seasoned pro!