Break the Cycle of Living Paycheck to Paycheck

Have you ever found yourself counting the days until the next paycheck arrives? You’re not alone. A considerable number of people are familiar with the stress of living paycheck to paycheck, constantly on the edge of financial uncertainty. But the good news is that this cycle can be broken, and financial freedom is within reach. This article will guide you through practical steps to gain control over your finances and bid farewell to the paycheck-to-paycheck lifestyle.

Understanding the Paycheck-to-Paycheck Cycle

Living paycheck to paycheck refers to a situation where an individual primarily relies on their most recent earnings to cover their expenses, with little to no savings in between. This can create a precarious financial balance where unexpected expenses or job loss could lead to significant financial strain.

Assess Your Financial Situation

Before diving into the strategies to escape this financial cycle, it’s essential to assess your current financial situation. This means looking closely at your income, expenses, and any outstanding debts. Create a detailed budget where you account for every dollar spent. This will help you identify unnecessary expenses that you can cut and redirect towards your savings.

Strategies to End the Paycheck-to-Paycheck Lifestyle

Breaking free from the clutches of living paycheck to paycheck is challenging but achievable with determination and strategy. Let’s look at several steps you can take to turn your financial life around.

1. Develop a Budget and Stick to It

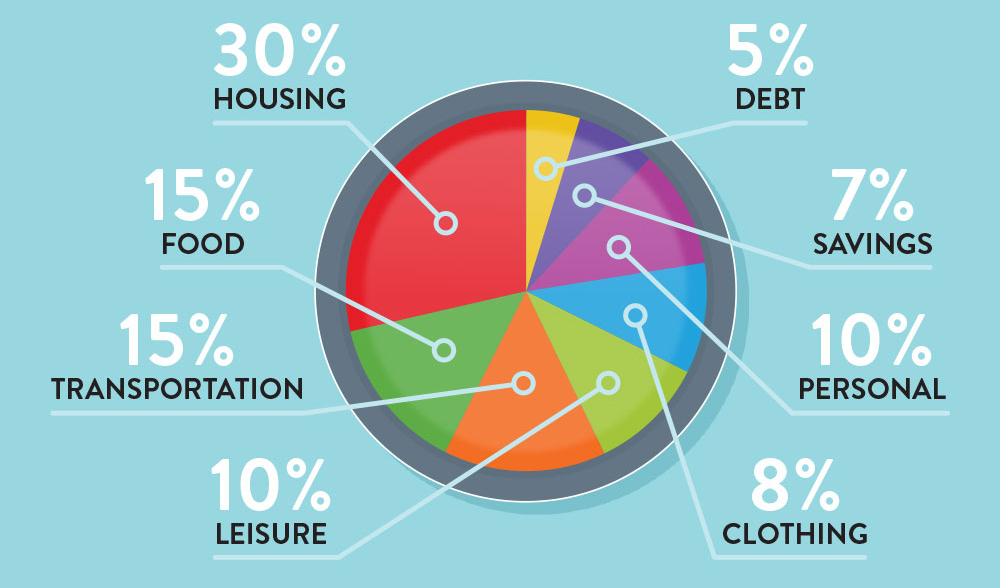

Creating a budget is the cornerstone of sound financial planning. Your budget should include all necessary expenses, such as rent, utilities, groceries, and transportation. Beyond these, allocate funds for savings and discretionary spending. Tools like budgeting apps can be helpful in tracking your spending habits and sticking to your budget.

2. Decrease Your Expenses

Look for areas where you can trim expenses. It might mean cutting down on dining out, cancelling subscriptions, or finding cheaper alternatives for services. Every bit helps and adds up to a substantial amount over time.

3. Prioritize Debt Repayment

High-interest debts, such as credit card debts, can quickly eat away at your income. Prioritize paying off these debts by allocating more than the minimum payment each month. Strategies like the debt snowball (paying off the smallest debts first) or the debt avalanche (targeting high-interest debts) can be particularly effective.

4. Set Up an Emergency Fund

An emergency fund is a safety net that can keep you afloat in times of unexpected financial needs, such as medical emergencies or car repairs. Aim to save at least three to six months’ worth of living expenses. Even small, regular contributions can grow into a significant reserve over time.

Boost Your Income

Reducing expenses is only one side of the equation. Increasing your income can significantly expedite your journey towards financial stability.

Seek Opportunities for Career Advancement

Consider opportunities for career growth that might lead to a higher salary, such as seeking promotions or pursuing additional qualifications. Professional development can potentially lead to more substantial financial gains.

Explore Side Hustles or Part-time Jobs

Side hustles or part-time jobs can supplement your income. Look for something that fits your skills and schedule. The extra income can be used to pay off debt faster, increase savings, or invest.

Make Saving a Habit

Consistently setting aside a portion of your income can turn saving into a habit. Automate your savings if possible, so that a fixed amount goes directly into a savings account each time you get paid. This “out of sight, out of mind” approach can be highly effective.

Invest in Your Future

Once you’ve established a robust savings account, consider investing to grow your wealth. Look into retirement accounts such as an IRA or a 401(k), often accompanied by tax advantages. You may also want to explore other investment options like stocks, bonds, or real estate, depending on your risk tolerance and financial goals. Remember, it’s advisable to seek guidance from a financial advisor when you’re starting out.

Seek Professional Financial Advice

If you’re struggling to break the paycheck-to-paycheck cycle on your own, you might benefit from professional financial advice. A financial advisor can help you devise a personalized strategy, suggest ways to optimize your budget, and guide you through investment choices.

Stay Motivated and Adjust as Needed

Maintaining your financial discipline is key to breaking the cycle. Celebrate small victories along the way to keep yourself motivated. Be ready to adjust your financial plan as you encounter changes in your income or expenses. Persistence and adaptability can help sustain your journey toward financial independence.

Conclusion

Living paycheck to paycheck can be a stressful and limiting experience. However, with the right mindset and tactics, it’s possible to escape this cycle. By assessing your financial situation, decreasing expenses, increasing income, and practicing regular saving habits, you can build a stronger financial foundation for the future. It takes time, effort, and a bit of sacrifice, but the peace of mind and financial security you’ll gain are well worth the endeavor. Start today, and take that first step towards a better financial future.