Avoiding Common Rental Scams: What to Look Out For

Finding a great place to live can be exciting, but it’s also fertile ground for scammers looking to make a quick buck. These fraudsters prey on the hopeful and unsuspecting, leaving them without a rental and out of pocket. Fortunately, with a keen eye and the right know-how, you can sidestep these traps laid out by scammers.

In this guide, we’ll walk through some of the most common rental scams and share tips on how to avoid them. By the end, you’ll be equipped to navigate the rental landscape with confidence, keeping your finances and peace of mind intact.

The Too-Good-to-Be-True Listing

First off, let’s talk about the listing that seems perfect—it’s in an ideal location, beautifully furnished, and the rent is surprisingly affordable. Your first instinct might be to jump on it, but here’s where caution is key. These listings are often fake, designed to attract many potential renters quick.

What to Watch Out For:

– Extremely low prices for the area

– High-quality photos that seem lifted from a magazine

– Descriptions that are vague or filled with grandiose language

How to Stay Safe:

Always compare prices with similar properties in the area. If it’s substantially lower without a good reason, proceed with caution. Do a reverse image search on the photos to see if they appear elsewhere on the internet.

The Invisible Owner

Next up is the elusive owner who’s always out of town. They might tell you they’re on a business trip or doing charity work overseas, but they’re so eager to rent you their home! Sound familiar?

What to Watch Out For:

– Owners who can’t meet you in person

– Requests for money transfers to “reserve” the property

– High-pressure tactics urging you to act fast before meeting them or seeing the property

How to Stay Safe:

Insist on a face-to-face meeting, or at least a virtual tour conducted by them, not a pre-recorded video. Never send money to someone you haven’t met in person or sign a lease before having someone you trust verify the property exists and is for rent.

The Missing Amenities

Scammers may also advertise amenities that don’t exist or are not included in the rental. They hook you with promises of a fully-equipped gym, a fancy rooftop deck, or a pet-friendly environment, but when you move in, those facilities are non-existent or come with an additional hefty fee.

What to Watch Out For:

– Listings that boast luxury amenities with no additional cost

– Inability to show you these amenities when asked

– Generic descriptions that could apply to any rental

How to Stay Safe:

Always verify the existence of the amenities by visiting the property in person or asking for real-time photos if you can’t. Read online reviews from other tenants and ask them about their experiences.

The Bait-and-Switch

This classic trick involves dazzling you with a fantastic apartment, only to switch it out for a less desirable one at the last minute. The scammers will make up an excuse as to why the original place is no longer available and offer you this “similar” one instead.

What to Watch Out For:

– Last-minute changes to the unit offered

– Excuses that seem insincere or illogical

– Pressure to accept the alternative without proper viewing

How to Stay Safe:

Stay firm on seeing the exact unit you’re interested in. If they can’t provide that, walk away. It’s better to miss out on a rental than to be caught in a scam.

The Overeager Landlord

Beware of landlords who seem in a rush to get your signature on the dotted line. They’ll skip the credit checks, bypass rental history reviews, and won’t care much about your employment status—anything to get you to commit quickly.

What to Watch Out For:

– Landlords who don’t ask for your identification or rental history

– Ignoring background or credit checks

– Urgency to rent without proper process

How to Stay Safe:

A reliable landlord will want to ensure their tenants are trustworthy and can pay the rent. If you’re not being asked for standard documentation, consider it a red flag.

The Fake Fee Fiasco

Lastly, watch out for the myriad of invented fees a scammer might hit you with. Application fees, background check fees, insurance fees—the list can be endless, with the only goal being to milk money from you before disappearing.

What to Watch Out For:

– Large sums of money requested up front under various pretenses

– Fees that are not clearly explained or detailed in the lease

– Requests for non-traditional payment methods like prepaid credit cards

How to Stay Safe:

Ask to see the official lease and have it reviewed before handing over any money. Know the average cost of fees in your area and question any that seem unusually high. Stick to traditional forms of payment that are traceable and can be reported if necessary.

Conclusion

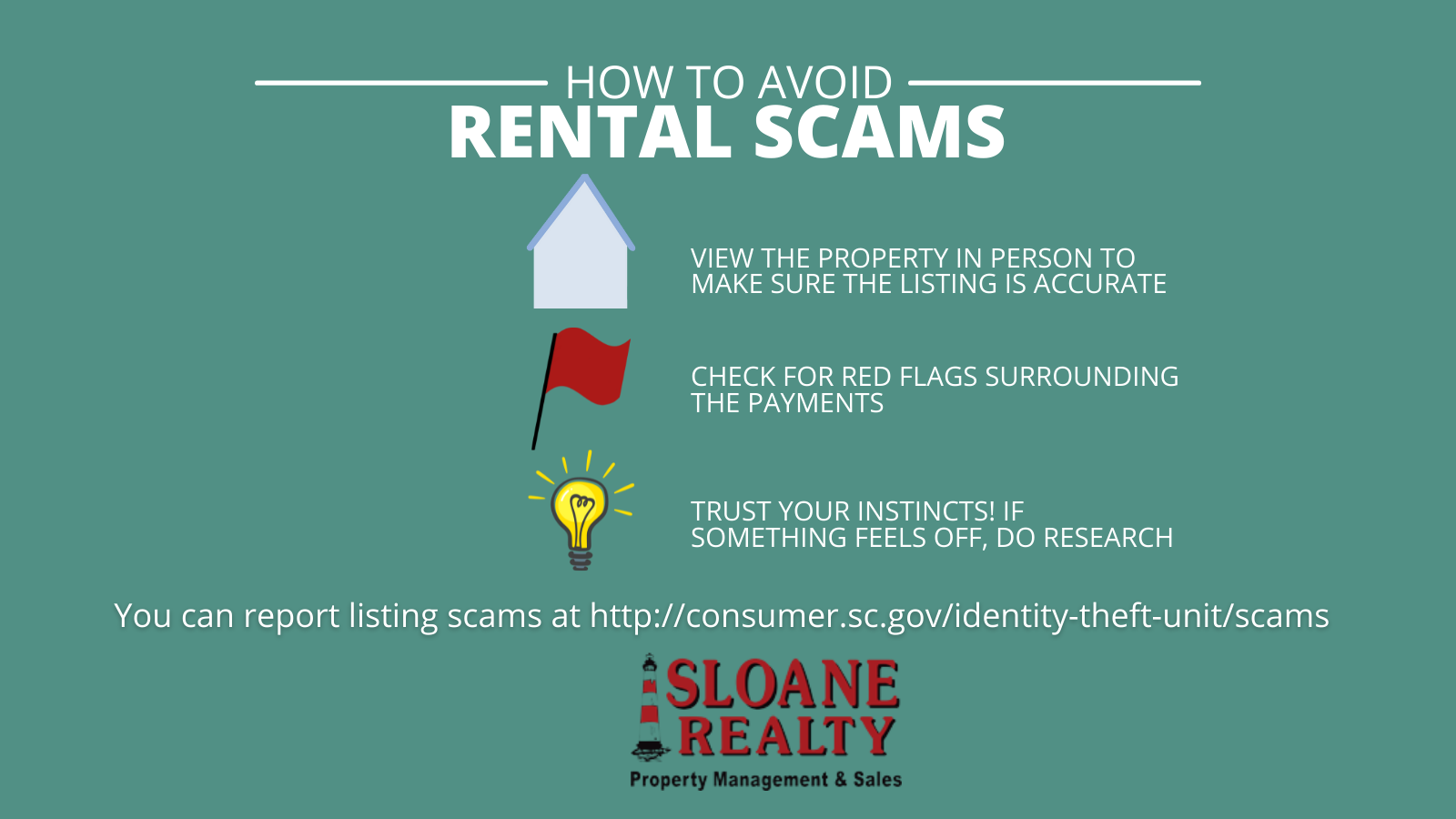

The search for a new home should be thrilling, not distressing. By keeping a close watch for these red flags and insisting on transparency at every stage, you can protect yourself against rental scams. Remember, if something feels off, it probably is. Take your time, do your homework, and don’t let impatience or excitement cloud your judgment. Be safe out there!