A Smart Guide to Accounts Payable: Key Strategies for Financial Mastery

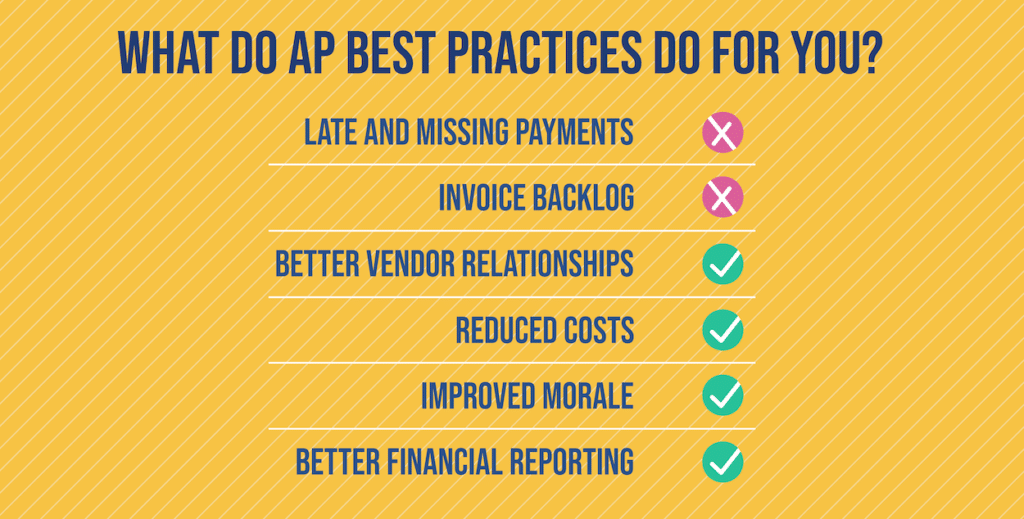

While the business landscape continually evolves, one truth remains unchanged: money matters. Among the myriad financial concepts, Accounts Payable (AP) is a critical component for maintaining your company’s fiscal health. Paying attention to how you manage your AP processes can lead to immeasurable benefits, helping to keep suppliers happy, cash flows smooth, and financial statements accurate. So, whether you’re a financial wizard or someone just dipping their toes into the corporate finance waters, these best practice tips will put you on the path to enhanced financial control in no time.

Laying Down a Solid Foundation: Accurate Data Entry

Everything starts with accurate data. When handling invoices, meticulous attention to detail is crucial. An error in recording the amount or the payee details can cascade into a financial nightmare. Make it a habit to double-check entries, and consider implementing a three-way match system for verifying the invoice, the purchase order, and the receiving report before payment. Automation software often helps prevent errors, but a human eye for detail is irreplaceable.

Embrace Technology: Automate the Mundane

Speaking of automation, technology is your ally in the battle against inefficiency. Automatic data capturing tools, electronic invoicing, and AP software streamline the workflow, minimizing tedious tasks and reducing human error. It’s not just about speed and accuracy, though. These tools can also provide real-time data, allowing for better decision-making. When you can see things clearly and quickly, managing your cash flow becomes a whole lot easier.

The Early Bird Gets the Discounts: Timely Payments

Always paying on time is essential but paying early can be even better. Many vendors offer early payment discounts which can add up to considerable savings over time. Craft a schedule that aligns with your cash flow while taking advantage of these opportunities. Plus, this is about building trust too. When vendors know they’ll get paid promptly, they’re more likely to offer better terms, and in business, relationships are key.

Maintain Good Relationships: Open Communication with Vendors

In line with the previous point, communication with your vendors should be open and clear. Misunderstandings about payment terms or disputes can sour relationships and disrupt your supply chain. Regularly touch base with your suppliers, be transparent about payment processes, and negotiate terms that work for both parties. A little chat can sometimes resolve issues that paperwork can’t.

Forecasting is Foreseeing: Cash Flow Management

Forecasting your cash flow is not about crystal balls; it’s about practicality. Through careful planning and monitoring, you can predict (and prepare for) future cash outflows. By understanding when your AP peaks, you can better manage your available cash and even negotiate terms with suppliers to ensure liquidity.

Safety First: Implement Internal Controls

To keep your financial house in order, you need internal controls in place. These controls help prevent fraud and ensure that all transactions are authorized and within company policy. Separation of duties is an excellent start; the person authorizing a payment should not be the same person processing it. Regular audits, either internal or external, serve as a check-and-balance system, deterring wrongdoing, and ensuring processes are followed.

Clean As You Go: Reconcile Accounts Regularly

Do not let un-reconciled items pile up. Routine reconciliation of your AP ledger with your general ledger is like tidying up—it keeps your financial housekeeping in check and wards off the chaos. Unearth discrepancies before they grow roots, and you not only save time but also avoid the panic that comes with trying to trace back through months of transactions.

Gather Intel: Reporting and Analysis

High-quality, timely reports are the treasure maps of the AP world. With the right data, you can uncover trends, identify areas of improvement, and support strategic decision-making. Regular analysis of your AP processes can reveal bottlenecks, inefficiencies, and even opportunities for further cost savings. In other words, never underestimate the power of good reporting.

Keep Growing: Continuous Improvement

It’s tempting to relax once everything’s running smoothly, but the best AP departments are always seeking improvement. Whether it’s adopting new technologies, renegotiating vendor terms, or providing additional training for the staff, the pursuit of better practices should never stop. Continuous improvement is not just a buzzword; it’s a mantra for financial success.

Education is Power: Train Your Team

Don’t overlook the human element. It’s essential that the entire team understands the significance of the AP process and how it fits into the broader financial picture. Training your staff not only on how to use systems but also why specific steps matter, creates a more competent and engaged team. When everyone’s on the same page, mistakes decrease, and efficiency soars.

Final Thoughts

Remember, managing your accounts payable is not just about paying bills. It’s about strategic financial control. By implementing these best practices, you’re taking important steps toward fortifying your company’s financial backbone. Accurate data entry establishes the groundwork; timely payments and open communication strengthen your vendor relationships; and a firm handle on cash flow keeps you nimble. Mix in robust internal controls and regular reconciliations to keep things tidy, spruce it all up with insightful reporting, and tie it all together with a philosophy of continuous improvement and education.

With solid practices in place, your AP department transitions from a simple cost center to a hub of value creation—a key contributor to the competitive edge of your business. Embrace these best practices, and you’ll navigate the complexities of AP with the finesse of a seasoned financial captain, steering your company toward the calm waters of fiscal stability.